CS Mbadi Reveals Snippets Of Tax Increases In The Finance Bill 2025

The administration will not make any new tax modifications to significant taxing avenues such as VAT and employment tax.

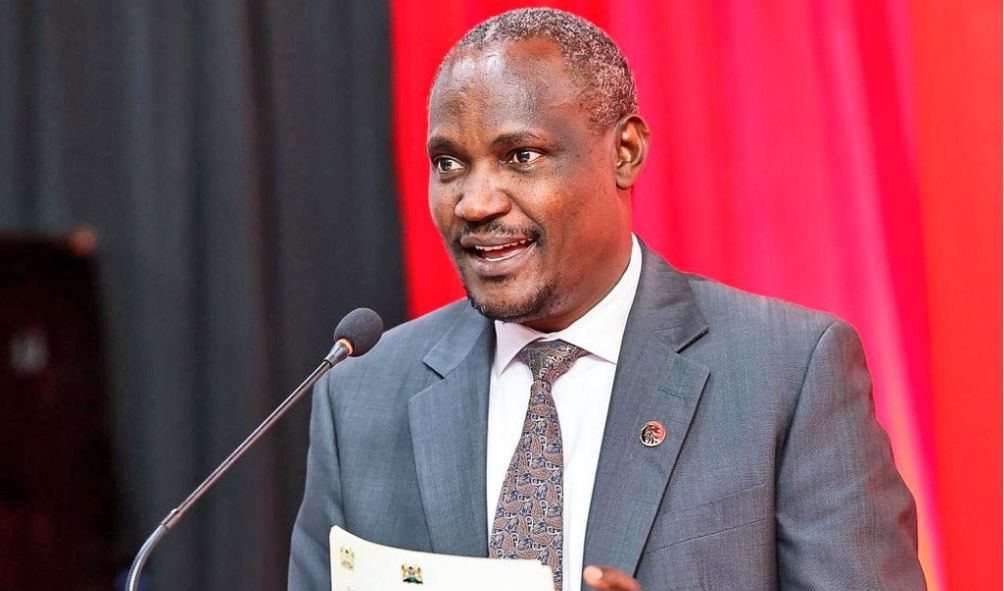

Treasury Cabinet Secretary John Mbadi has indicated that the impending Finance Bill 2025 would be submitted to the National Assembly for approval.

Mbadi explained that the decision was motivated by a desire to relieve Kenyans of the burden of excessive taxation.

The CS spoke during an informal meeting with the Bunge la Wananchi caucus in Nairobi on Monday, February 3.

The CS went on to say that the government had reached a point where there was no more room for manoeuvre in terms of taxing work income.

The Finance Bill 2025 may not include any upward tax adjustments. We cannot continue overtaxing Kenyans – CS John Mbadi pic.twitter.com/kqRGDahwvm

— Kenyans.co.ke (@Kenyans) February 3, 2025

“The Finance Bill of this year may not have any tax adjustments upwards in terms of rates. We cannot overtax Kenyans anymore,” Mbadi announced.

“We have reached the limit where we are saying no more space for taxation especially on employment income. You will not see any more taxes on employment income under my watch as the CS,” he added.

Mbadi’s decision, however, may provide some comfort to Kenyans who are already burdened by taxation, primarily through deductions.

Treasury CS argues that the reason why we had Finance Bill 2024 trigger pervasive protests was because of targeting >Kes 300.0 billion & the government has taken a decision not to go that route again.

— Julians Amboko (@AmbokoJH) February 3, 2025

Interesting considering the Draft Budget Policy Statement 2025 indicated… https://t.co/J2XPk56VUr pic.twitter.com/mUQKDmq2hj

The majority of the deductions come from the Social Health Insurance Fund, affordable housing, and other statutory deductions levied from Kenyan income.

Following a High Court order on October 22, last year, the government was granted clearance to proceed with the Affordable Housing Levy deductions, which are set at a standard rate of 1.5 percent of an employee’s gross wage or a person’s gross income received or accumulated.

ALSO READ:

- DCP’s Malala Explains Why United Opposition Chiefs Snubbed Gachagua’s Return

- UK To Pay A Measly Ksh22K To BATUK’s Fire Victims In Laikipia

- Wetangula, CJ Koome Exchange Words Over Courts-Parliament Relationship

- VIHIGA: COP Shoots Dead A Colleague Before Disappearing

- CHAN PRIZE MONEY: Breakdown Of All Participants As Kenya Bags Ksh58 Million

Employers were also compelled to remove an equivalent 1.5% of their employees’ salary, bringing the total contribution to 3%.

The CS also justified his proposed modification to the Pensions Fund Act, claiming that the proposal to exempt pension funds from taxation was designed to protect the general population from exorbitant taxes.

Furthermore, he stated that the government’s decision was motivated by the need to encourage more Kenyans to save, resulting in improved protection for elderly residents’ social pensions.

“One of the reasons as to why I brought that amendment, was to protect myself and other Kenyans when I retire so that when I get my pension I take out the whole of it without surrendering anything in the form of tax,” Mbadi stated.

CS Mbadi Reveals Snippets Of Tax Increases In The Finance Bill 2025